- Home

- Marketplace

- Banking

Get better business banking

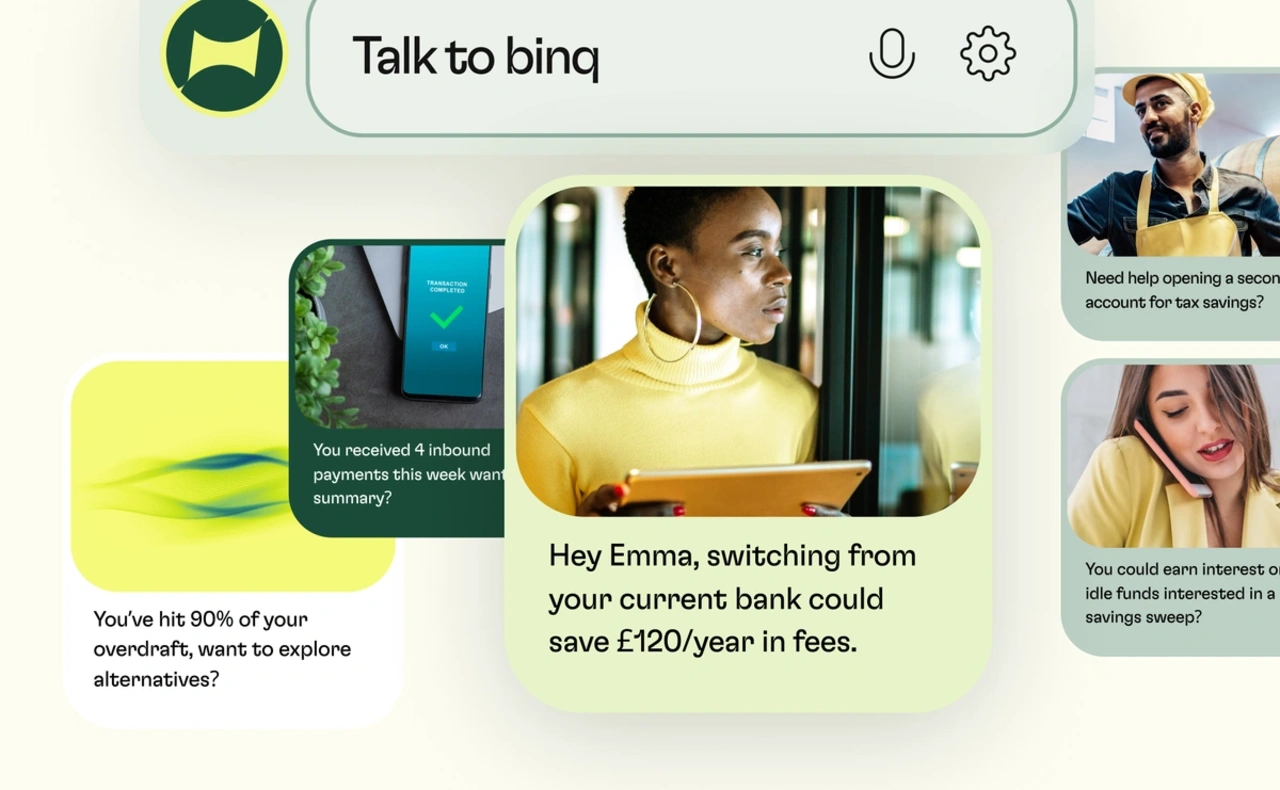

- Intelligent recommendations tailored to your business size and banking needs

- Clear breakdown of benefits, from cashback rewards to credit-building tools

- Expert guidance to help you choose the right banking features for growth

Binq's recommendations

ANNA Money Business Account

The all-in-one account for freelancers, start-ups & LTDs. Fast setup, no monthly fees, automated invoices, tax tools, employee cards, and responsive 24/7 support.

- No monthly fee / Start your account for free

- Fast sign up / Open in under 10 minutes

- 24/7 support / UK-based, fast in-app help

- Easy account management / In-app & online

- Automated invoices / Match receipts & transactions

- Cashback rewards / On business spending

- Employee cards / Control limits & track expenses

- Payment options / Links & QR codes

- Tax tools / VAT & Corporation Tax management

- Smart automation / Save time on admin & bookkeeping

ANNA Money Business Account

The all-in-one account for freelancers, start-ups & LTDs. Fast setup, no monthly fees, automated invoices, tax tools, employee cards, and responsive 24/7 support.

- No monthly fee / Start your account for free

- Fast sign up / Open in under 10 minutes

- 24/7 support / UK-based, fast in-app help

- Easy account management / In-app & online

- Automated invoices / Match receipts & transactions

- Cashback rewards / On business spending

- Employee cards / Control limits & track expenses

- Payment options / Links & QR codes

- Tax tools / VAT & Corporation Tax management

- Smart automation / Save time on admin & bookkeeping

Who needs it?

Business owners who want to spend less time on admin and more time growing.

Perfect for freelancers, start-ups & LTDs looking for seamless invoicing, smart expense tracking, cashback rewards, and round-the-clock support.

Set up in minutes, manage everything from your phone, and keep your finances effortless.

Zempler Bank Business Go Account

- No monthly fee / Save on costs

- Fast sign up / Apply in minutes

- Easy banking / In-app & online

- Pay in cash / At 11,500 Post Offices

- FSCS protection / Up to £85,000

- 24/7 fraud monitoring / Always on

- UK support / Telephone customer service

- Cashflow tools / Tracking & insights

Zempler Bank Business Go Account

- No monthly fee / Save on costs

- Fast sign up / Apply in minutes

- Easy banking / In-app & online

- Pay in cash / At 11,500 Post Offices

- FSCS protection / Up to £85,000

- 24/7 fraud monitoring / Always on

- UK support / Telephone customer service

- Cashflow tools / Tracking & insights

Who needs it?

The bank account that helps you get your business off the ground.

For sole traders, start-ups & small businesses.

Fast signup, no monthly fees, 24/7 fraud monitoring, cashflow tracking & integrated accounting tools.

Scan the QR code to download the App

Download the App

Bank in a way which works for your business.

Personalised and flexible options to help you manage cash flow, reduce banking costs, separate personal and business finances, or expand internationally.

- Smart searches and easy applications

- Accounts tailored to your business needs

- Competitive rates and fees that make sense

FAQs

Business accounts are designed for company finances and help you separate personal and business money. They often offer better payment processing, business-specific features, and make your accounting much easier come tax time.

Most banks accept applications from sole traders and new businesses, though you'll need to provide business registration details. Some accounts are specifically designed for startups and early-stage companies.

Costs vary widely between providers. Some offer free banking for new businesses or accounts with low transaction volumes. Others charge monthly fees but include more services. Compare the total cost based on how you'll actually use the account.

You'll typically need business registration documents, proof of address, identification for all account signatories, and sometimes recent financial statements. Requirements vary between banks.

While possible for very small operations, it's not recommended. Business accounts provide better record-keeping, may be required for certain business structures, and help establish your business credit history.

Consider monthly fees, transaction charges, online banking features, payment processing options, overdraft facilities, and integration with accounting software. Choose based on your actual business needs.

Overdrafts let you spend more than what's in your account, up to an agreed limit. You only pay interest on what you use. They're great for managing short-term cash flow gaps.

Banks typically charge fees for exceeding transaction limits or going over your overdraft. These can add up quickly, so monitor your account regularly and speak to your bank if you need higher limits.

Yes, though your options may be more limited. Some banks specialize in accounts for businesses with credit challenges. Building a good banking relationship can help improve your access to other business finance later.

Many businesses start with just a current account, then add savings or specialized accounts as they grow. Consider separate accounts for different purposes - like tax savings or different business divisions - but keep it manageable.