Upload your documents

Compare offers from 100’s of lenders, and find your best energy and insurance options.

Speak with one of our experts, and get 24/7 support from your personal AI business advisor.

Whether you’re looking to borrow to grow your business, access short-term finance, or to get immediate working capital to cover costs, we have the right option for you.

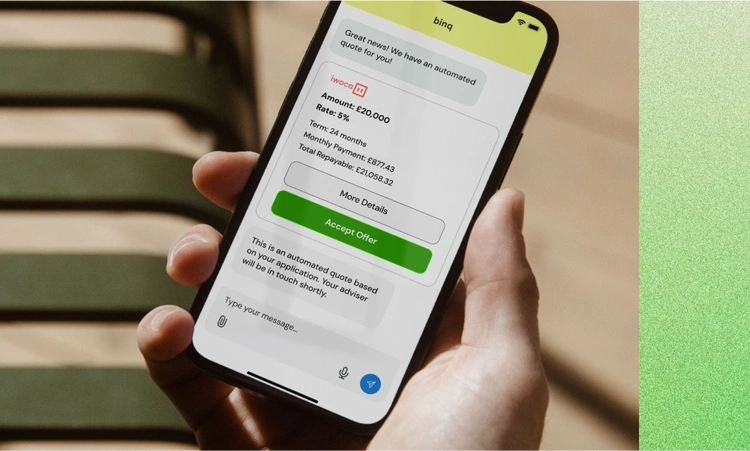

Find your best loan options in minutes, with open banking technology and your personal AI business advisor.

Compare offers from 100’s of lenders, and find your best energy and insurance options.

Speed up applications, give lenders better insights, and find better offers for your business.

We will analyse your information, and match you with banks who are happy to lend to you in minutes.

If you have any questions, one of our experts will be available to speak with you via our app, or on the phone.

Fast approval, so business doesn’t wait.

Personalised and flexible options to help you grow your business, consolidate debt, smooth cashflow, or buy new stock and equipment.